IR35 and off payroll working explained

As of 6th April 2021 new rules apply for companies hiring temporary workers

GET A FREE IR35 HEALTH CHECK

IR35 (off payroll working)

New rules from April 2021

As of 6th April 2021 medium and large businesses (as defined under the Companies Act 2006) become responsible for determining the employment status of any limited company contractors it engages either directly or through an intermediary such as a recruitment agency.

What's changing

How this affects your business

Any contractors deemed to be ‘inside IR35' i.e. employed for tax purposes must have PAYE & NI deducted at source and the payrolling entity (e.g. the recruitment agency) must also pay Employers NI and the Apprenticeship Levy.

Where these statutory payments are not made, the liability for those payments can sit with the hiring company or intermediary.

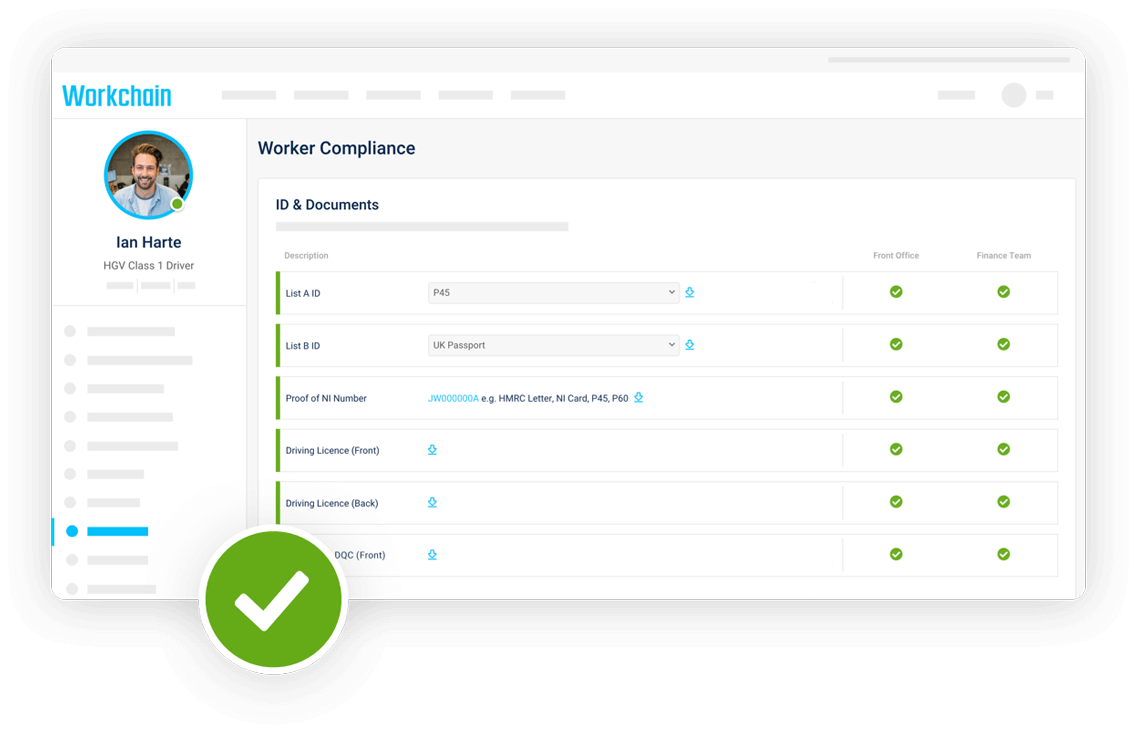

Hiring flexible workers

What defines a limited company

contractor as employed for tax purposes?

There are a number of factors to take into account

Supervision and control

Do you as the hirer control when, where and how the individual's work is completed?

Right of substitution

Can the individual send a replacement worker to carry out the job or must they complete the work themselves?

Mutuality of obligation

Do you expect the worker to undertake the work when asked to do so and does the worker expect you to provide consistent work?

Provision of equipment

Does the worker provide their own equipment or do you provide the equipment?

Financial risk

To what extent is there any financial risk to the worker in performing the work required or does the risk lie with you as the hirer?

Basis of payment

Is the worker paid per hour or per day, or are they paid a fixed price for carrying out the job?

Part and parcel

Does the worker have access to staff facilities, attend staff meetings, receive staff benefits etc? To what extent have they become a member of the team?

Exclusivity of service

Does the worker provide their services exclusively to one client?

What to do

Protect your business

Book a free IR35

health check

Want to eliminate financial risk from your supply chain? Get in touch to book a free health check with one of our employment advisors.